Why Ethereum AUD Price Matters for Savvy Investors

Cryptocurrency has taken the financial world by storm. It offers new and exciting investment opportunities for individuals and institutions alike. In Australia, the crypto market has gained significant traction. One cryptocurrency that has been making waves is Ethereum. This article will explore why the Ethereum AUD price matters for savvy investors in Australia and how a price chart that shows the conversion can provide valuable insights.

Why is Ethereum Significance in Australia

In Australia, Ethereum has gained popularity due to its diverse applications. It is used in various sectors, including finance, supply chain management, healthcare, and gaming. Moreover, the Australian government has been relatively supportive of blockchain technology. In this way, it further contributes to the growth of Ethereum and other cryptocurrencies in the country.

The Significance of Ethereum Price

For investors in Australia, the Ethereum AUD price is important. Here’s why:

Portfolio Diversification: Savvy investors understand the importance of diversifying their portfolios. Cryptocurrencies like Ethereum offer a unique asset class that can help spread risk. Monitoring the AUD price allows investors to assess the performance of their crypto holdings in relation to the Australian dollar.

Hedging Against Traditional Markets: Traditional financial markets are often influenced by economic and geopolitical factors. Ethereum is a decentralized and global asset. It can serve as a hedge against such market volatility. Investors in Australia can rely on Ethereum to mitigate losses in their traditional investments potentially.

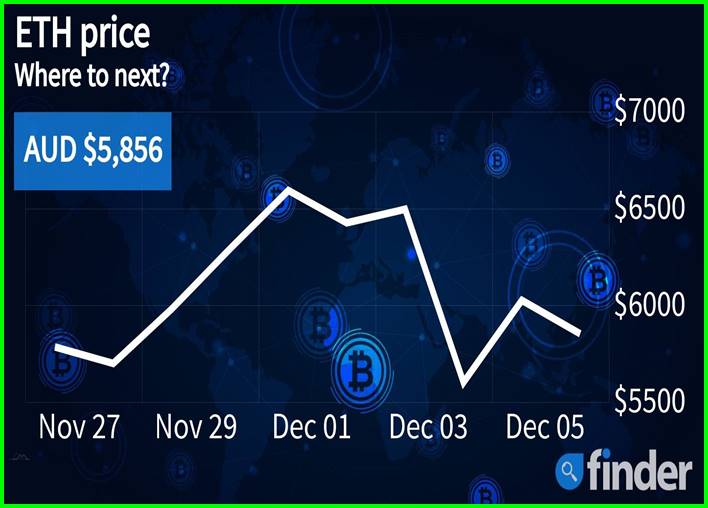

Timing of Investments: The Ethereum AUD price chart provides valuable insights into the cryptocurrency’s historical performance. Investors can use this data to know when to buy or sell Ethereum. Timing is crucial in the volatile crypto market, and having access to accurate price information is essential.

Tax Implications: In Australia, cryptocurrency transactions are subject to taxation. Keeping track of the Ethereum AUD price helps investors calculate their capital gains and losses accurately, ensuring compliance with tax regulations.

The Role of Price Charts in Investment Decision-Making

Price charts that show the conversion of Ethereum to AUD are indispensable tools for investors. These charts provide a visual representation of Ethereum’s performance in the Australian market. Here’s how they can help:

Technical Analysis: Price charts allow investors to perform technical analysis. It is a method that predicts future price movements using historical data. By analyzing patterns, trends, and indicators on the chart, investors can make more informed decisions.

Identifying Support and Resistance Levels: Price charts help identify key support and resistance levels. Support levels indicate where the price is likely to find buying interest. Resistance levels show where selling pressure may emerge. This information is valuable for setting entry and exit points.

Chart Patterns: Investors can use price charts to spot chart patterns like head and shoulders, double tops, and flags. These patterns provide information about potential price reversals or continuations.

Benefits of Investing through a Crypto Exchange

Investing in Ethereum through a reputable crypto exchange offers several advantages for Australian investors:

Accessibility: Crypto exchanges make it easy for investors to buy, sell, and trade Ethereum. They provide user-friendly platforms and mobile apps, allowing investors to manage their portfolios conveniently.

Security: Established crypto exchanges prioritize security measures to protect user funds. Features like two-factor authentication (2FA) and cold storage of assets help safeguard against unauthorized access and cyber threats.

Liquidity: Ethereum is one of the most liquid cryptocurrencies. Trading on a reputable exchange ensures that investors can execute their orders efficiently, even during times of high market activity.

Regulatory Compliance: Many Australian crypto exchanges adhere to local regulations. By doing so, they provide investors with a level of trust and transparency. This is particularly important in a market that is still evolving and subject to regulatory changes.

In conclusion, the Ethereum AUD price holds great significance for savvy investors in Australia. It allows for portfolio diversification, acts as a hedge against traditional markets, helps in timing investments, and aids in tax compliance. Price charts that display the conversion offer valuable insights, enabling technical analysis and decision-making.

The Delaware Advantage: How DSTOs Protect Property Owners

Why Ethereum AUD Price Matters for Savvy Investors